"Buy generic gramaxin online, antimicrobial bedding".

By: Q. Steve, M.A., M.D., M.P.H.

Assistant Professor, Ponce School of Medicine

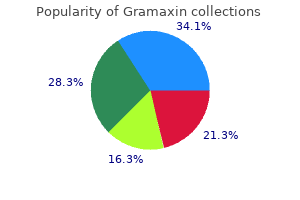

Figures 1 and 3 illustrate the geographic distribution of vulnerable and "extremely" vulnerable populations antibacterial liquid soap buy line gramaxin, respectively antibiotics for uti in elderly order gramaxin with a visa. To quantify how correlated these two measures are antibiotics used to treat mrsa buy gramaxin overnight delivery, we estimate a population-weighted regression of the county-level share of vulnerable beneficiaries on the county-level share of extremely vulnerable beneficiaries. There are, however, some differences in the patterns that we will briefly remark upon here. For example, at the southern tip of Texas, there are areas where the proportion of individuals in the top 1% of vulnerability is very high (black) relative to other counties but the proportion of individuals in the top 25% is more moderate. The opposite is also true, with there being counties where the relative frequency of individuals in the top 1% is low but the frequency of individuals in the top 25% is moderate. Although some of this variation may be due to noise, many of the important correlates of vulnerability identified in figure 2, such as income, are known to vary within counties. Vulnerability and Pollution Levels Given the high degree of geographic variation in vulnerability, it is natural to investigate whether that variation is correlated with variation in underlying pollution levels. For example, it may be that a given pollution shock is more deadly in regions that already have high pollution levels. Indeed, this hypothesis is at least consistent with the idea that pollution regulation should be targeted at locations with high pollution levels. Indeed, residential sorting on the basis of air pollution levels has been documented in numerous prior studies (see Banzhaf, Ma, and Timmins 2019 for a review). In addition, if we were to interpret this relationship causally, it suggests that reducing average pollution levels makes individuals more vulnerable to pollution spikes and vice versa. However, because the relationship is far from perfect, targeting counties based on pollution levels would still be less effective in reaching vulnerable individuals than targeting based on vulnerability. By contrast, a policy targeting the same number of counties based on how many vulnerable beneficiaries live there would reach 60. Overall, figure 6 lends additional support to the idea that targeting regulation at highly polluted areas may be less beneficial for population health than simple intuition would suggest. As shown in table 1, the Medicare beneficiaries who are most vulnerable to air pollution are less healthy than the average beneficiary. Our paper computes a proxy indicator for the conditional average treatment effect for each individual in our data and uses that to classify individuals as vulnerable or not vulnerable to acute air pollution. Geographic and Socioeconomic Heterogeneity of Reducing Air Pollution 177 As one might expect, we find that vulnerability is positively and significantly associated with a range of health indicators. Highly vulnerable individuals are also likely to spend more on health care and to consume more health-care services. We aggregate across individuals within a particular geographic area to investigate geographic heterogeneity. At the county level, we find a large degree of variation in the share of individuals in the top quartile of vulnerability, ranging from below 5% to above 50%. The areas with the highest proportion of individuals in the vulnerable category lie in an L-shaped band that ranges from the Dakotas south to Texas and then eastward through the Gulf Coast states toward Georgia and Northern Florida. An additional group of areas with large shares of vulnerable elderly falls in eastern Kentucky and West Virginia. In contrast, many of the counties in New England and Pacific Coast states have lower-thanexpected shares of vulnerable residents. Given the large amount of county-level heterogeneity, we next turn toward investigating the geographic and socioeconomic correlates. As might be expected from the individual-level analysis, we find that vulnerability and health tend to be positively correlated at the county level as well. Counties with high shares of individuals who report exercising have low shares of vulnerable individuals, whereas counties with high levels of smoking, obesity, and elderly mortality rates have high shares of vulnerable individuals. The relationship between health-care infrastructure and vulnerability tends to be more mixed, with high numbers of physicians per capita and high hospital quality correlating with low vulnerability, whereas having a high number of hospital beds per capita and high Medicare spending per beneficiary are both correlated with higher vulnerability. The reasons for this discrepancy are not obvious, although reverse causation likely plays a role: areas with more vulnerable people will tend to have higher Medicare spending and higher mortality. Turning to socioeconomic indicators, counties with high average income and home values have lower shares of vulnerable individuals, whereas counties with high poverty levels have higher shares.

Blisterweed (Buttercup). Gramaxin.

- Arthritis, blisters, bronchitis, chronic skin problems, nerve pain, and other conditions.

- Are there safety concerns?

- How does Buttercup work?

- What is Buttercup?

- Dosing considerations for Buttercup.

Source: http://www.rxlist.com/script/main/art.asp?articlekey=96646

This is because all individuals wish to antibiotics with alcohol order gramaxin 625mg visa serve their self-interest and infection xpert buy gramaxin with a visa, unless they are able to virus versus bacteria buy cheap gramaxin 625mg do so, their behaviour will not be conducive to the realization of optimum efficiency in the use of resources. Any effort to prevent the individuals from serving their selfinterest, as socialism tried to do, is bound to fail. What Adam Smith did to overcome the conflict between the two interests was to try to show that the serving of self-interest by every individual also served the social interest. Since this is not necessarily true, as we have already shown, therefore, in order to realize the harmonization of individual and social interests, the individuals should be made to recognize the opposite of what Adam Smith said - that the serving of social interest also serves their self-interest. Islam does not prevent the individual from serving his self-interest, but by giving self-interest a spiritual, long-term perspective extending its span beyond this life. On the other hand, the evils of greed, unscrupulousness and disregard for the rights and needs of others, which the secularist and short-term this-worldly perspective of both capitalism and socialism tend to promote, are overcome by introducing an internal selfregulating mechanism with its unrelenting emphasis on belief in God, moral values, accountability before Him, human brotherhood, and socio-economic justice. The idea of accountability before the Supreme Being can serve as a strong motivating force in inducing individuals to abide by moral values and in preventing them from pursuing self-interest beyond the limits of social health and well-being. Competition and market forces, which according to Adam Smith performed this function, are undoubtedly essential for playing a complementary role, but are not effective enough to ensure the interest and well-being of all. This is because: firstly, competition can also be unhealthy, and secondly, this-worldly self-interest, unhindered by moral compunctions, may tend to find different ways of restraining competition and thwarting the operation of market forces, particularly when wealth and power are also unequally distributed. Socio-economic Restructuring Values may, nevertheless, be violated and the idea of accountability before God may, in many cases, be too feeble to have much impact on human behaviour. Even in a morally-charged society, individuals may tend to be oblivious to the problems of scarcity and to social priorities in resource allocation, if the socio-economic environment is not conducive. They may simply be unaware of the urgent and unsatisfied needs of others, and, if they are well-to-do, may unconsciously follow unhealthy social trends and divert 61 scarce resources away from the need fulfillment of others, in order to satisfy their relatively less urgent wants. It is necessary, therefore, to reinforce moral values by socio-economic restructuring in such a manner that individuals find it possible to serve their self-interest only within the constraints of social well-being and economic stability. Role of the State Such a restructuring may not take place effectively unless all forces involved in it act in a concerted manner. The government must also, therefore, play a positive, goal-oriented role in the economy. It is rather a complementary role which is to be played by the government through the internalization of Islamic values in society, the creation of a healthy socioeconomic environment, and the development of proper enabling institutions, and not through excessive controls, unnecessary violation of individual freedom, and abolition of property rights. In contrast with this, the governments in poorer Muslim countries have, in general, been inwardly (though not outwardly) secular, in step with the conventional wisdom borrowed by them from the Western secular culture which occupies a dominant place in the present-day world. Their policies have, therefore, lacked a firm direction and have oscillated on the waves of socialism and free enterprise, and controls and decontrols that have been in vogue in development literature over the last four decades. This lack of firm direction, combined with fluctuations and inconsistencies in policies, has generated uncertainties and caused immense harm to the developmental process. Whatever development has been achieved has been at a high cost in terms of macroeconomic imbalances, increased inequalities of incomes and wealth, and social tensions. What the Muslim countries need, therefore, is to move away from the secular and inconsistent approach of Development Economics and to reformulate their policies within the framework of the integrated approach of Islam. However, while reformulating policies within this framework, it is neither possible nor necessary to find a precedent for all of them in the early Islamic history. Although the Shari`ah has prescribed the essential elements of a basic strategy, it has allowed flexibility over space and time by not spelling out detailed policy measures. It may be possible to emulate the experience of other countries with respect to specific policies. But, while doing so, it is necessary to ensure that the policy measures being considered for adoption fulfill two criteria - that they make a positive contribution towards the realization of the maqasid without coming into conflict with the Shari`ah, and that they do not lead to an excessive increase in the claims on resources. The second criterion should not be fulfilled within the framework of Pareto optimality. A strategy that concerns itself with increasing resources for a specific purpose without effectively reducing its availability for other purposes, can only lead to frustrations and imbalances. The testing of all policy measures against these criteria will strengthen the hand of governments in getting the policies publicly accepted, particularly policies which do not satisfy the criterion of Pareto optimality. Five policy measures are suggested below for development combined with justice and stability. These are: (1) invigorating the human factor; (2) reducing concentration of wealth; (3) economic restructuring; (4) financial restructuring; and (5) strategic policy planning.

Selective deficits in blood dendritic cell subsets in common variable immunodeficiency and X-linked agammaglobulinaemia but not specific polysaccharide antibody deficiency antibiotic essentials 2015 discount gramaxin 1000mg line. Comparison of American and European practices in the management of patients with primary immunodeficiencies antibiotics for dogs for bladder infection order 375 mg gramaxin with mastercard. Effectiveness of immunoglobulin replacement therapy on clinical outcomes in patients with primary antibody deficiencies: results from a multicenter prospective cohort study antibiotic 8 month old purchase gramaxin in united states online. Alterations in the half-life and clearance of IgG during therapy with intravenous gamma-globulin in 16 patients with severe primary humoral immunodeficiency. Prospective audit of adverse reactions occurring in 459 primary antibody-deficient patients receiving intravenous immunoglobulin. Relationship of the dose of intravenous gammaglobulin to the prevention of infections in adults with common variable immunodeficiency. Results of a prospective controlled two-dose crossover study with intravenous immunoglobulin and comparison (retrospective) with plasma treatment. Long term use of intravenous immune globulin in patients with primary immunodeficiency diseases: inadequacy of current dosage practices and approaches to the problem. Use of intravenous immunoglobulin and adjunctive therapies in the treatment of primary immunodeficiencies. A working group report of and study by the Primary Immunodeficiency Committee of the American Academy of Allergy, Asthma & Immunology. Increased risk of adverse events when changing intravenous immunoglobulin preparations. The use of intravenous immunoglobulin in the treatment of autoimmune neuromuscular diseases: evidence-based indications and safety profile. Acute thromboembolic events associated with intravenous immunoglobulin infusion in antibody-deficient patients. High-dose immunoglobulin replacement therapy by slow subcutaneous infusion during pregnancy. Slow subcutaneous immunoglobulin therapy in a patient with reactions to intramuscular immunoglobulin. Rapid subcutaneous IgG replacement therapy is effective and safe in children and adults with primary immunodeficiencies-a prospective, multi-national study. Efficacy and safety of home-based subcutaneous immunoglobulin replacement therapy in paediatric patients with primary immunodeficiencies. Efficacy and safety of Hizentra, a new 20% immunoglobulin preparation for subcutaneous administration, in pediatric patients with primary immunodeficiency. Efficacy and safety of a new 20% immunoglobulin preparation for subcutaneous administration, IgPro20, in patients with primary immunodeficiency. Pharmacokinetics and safety of subcutaneous immune globulin (human), 10% caprylate/chromatography purified in patients with primary immunodeficiency disease. Pharmacokinetics of subcutaneous IgPro20 in patients with primary immunodeficiency. Recombinant human hyaluronidase-facilitated subcutaneous infusion of human immunoglobulins for primary immunodeficiency. The comparison of the efficacy and safety of intravenous versus subcutaneous immunoglobulin replacement therapy. Subcutaneous immunoglobulin replacement in patients with primary antibody deficiencies. Safety and efficacy of subcutaneous human immunoglobulin in children with primary immunodeficiency. Subcutaneous immunoglobulin replacement in patients with primary antibody deficiencies: safety and costs. Rapid subcutaneous IgG replacement therapy at home for pregnant immunodeficient women. The life situations of patients with primary antibody deficiency untreated or treated with subcutaneous gammaglobulin infusions. Safety of rapid subcutaneous gammaglobulin infusions in patients with primary antibody deficiency. Safety and efficacy of home-based subcutaneous immunoglobulin G in elderly patients with primary immunodeficiency diseases. Induction of unresponsiveness against IgA in IgA-deficient patients on subcutaneous immunoglobulin infusion therapy. Safety and efficacy of self-administered subcutaneous immunoglobulin in patients with primary immunodeficiency diseases.

To make up for these shortfalls bacteria chapter 7 order gramaxin master card, Boone County cut back services such as its solid waste program antibiotic antimycotic order genuine gramaxin online. To attract more investment and employment by coal companies anti bacteria purchase 375 mg gramaxin free shipping, West Virginia passed two bills in 2019 giving tax breaks to the coal industry. House Bill 3142 reduces for 2 years the severance tax rate from 5% to 3% on coal that is used in power plants. In Wyoming, coal generates government revenues through four main instruments: property taxes, federal mineral royalties, coal lease bonuses, and severance taxes. Coal-related revenues to the state travel via various trust funds to a myriad of substate jurisdictions. Some are targeted to specific local expenditure categories, and some amounts are contingent on whether a certain revenue threshold is exceeded. The composition of 2018 revenues to the Campbell County government appears in figure 11 (Campbell County 2018a, 25). It includes the county tax on assessed property values and an ad valorem tax on the value of minerals extracted in the county, including coal, natural gas, and oil. The next-largest revenue sources are the sales and use tax and intergovernmental transfers. A 2017 special report by the Campbell County Board of Commissioners sheds some light on this. Likewise, it is unclear what shares of intergovernmental transfers flow from state coal-related revenues. In 2018, including revenues to the county government, the school system, and other special districts within the county, the property and production tax in Campbell County raised more than $266 million. Proactive decisions by this board, and previous boards, helped to make this transition as painless as possible because of substantial investments in savings and reserves, a relatively new age of facilities and plants, and an early retirement incentive that lowered employment expenses. To prepare for a future with lower coal production, the county established reserve and maintenance funds for capital replacement, vehicle Revenue at Risk in Coal-Reliant Counties 99 fleet management, buildings, and recreation facilities. Nonetheless, concerns are rising that coal production in Wyoming is declining faster than the area can absorb (Richards 2019). Wind power development in the Midwest is dampening demand for coal in key markets, and natural gas prices remain low. Layoffs at Powder River Basin coal mines follow the pandemic-driven declines in power demand. Like Boone County, Campbell County has experienced the costs of coal-related bankruptcies, and more could be on the horizon. The 2015 bankruptcy of coal producer Alpha Natural Resources left Campbell County with more than $20 million in unpaid taxes. Campbell County litigated and collected most of the money, but its legal expenses were significant. Subsequently, local leaders have called for changes in laws and tax collection structures in Wyoming to place the interests of taxing entities above investors and creditors (Campbell County 2018; McKim 2018). Along with its neighbors, McLean County and Oliver County, Mercer County is home to the largest mines in North Dakota. These counties primarily produce lignite coal, nearly 80% of which is used to generate electricity. However, coal-producing counties like Mercer are highly dependent on coal and would face major shortfalls if the industry collapses. Three main county revenue streams derive from coal-related revenue at the state level that the state then transfers to counties and other substate jurisdictions. The state deposits 30% of the revenue from the severance tax into a permanent trust fund that distributes construction loans to school districts, cities, and counties affected by coal development (North Dakota Tax Commissioner 2018, 16). The state also imposes a coal conversion tax on operators of facilities that produce electricity from coal or convert coal to gaseous fuels or other products. The North Dakota state government provides documentation of its payments to substate jurisdictions, so we can quantify the flows to 100 Morris, Kaufman, and Doshi Mercer County. According to the North Dakota state tax website, in 2018, Mercer County government received $1. We do not know how much of the mineral royalty distribution is related specifically to coal.